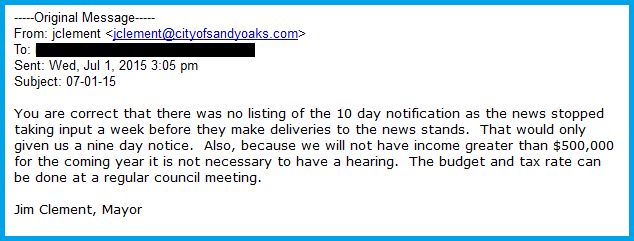

Mayor Jim Clement told a citizen of Sandy Oaks on July 1, 2015 that it wasn’t necessary for the City Council to have a Budget Hearing.

The reason Clement gave for not needing a Budget Hearing was that the city’s revenue would be less than $500,000

Texas Tax Hearing Law

With regards to a Tax Hearing, Texas Tax Code Section 26.052 defines the requirements for cities with a revenue of under $500,000.

Section 26.052 (c) A taxing unit to which this section applies may provide public notice of its proposed tax rate in either of the following methods not later than the seventh day before the date on which the tax rate is adopted:

(1) mailing a notice of the proposed tax rate to each owner of taxable property in the taxing unit; or

(2) publishing notice of the proposed tax rate in the legal notices section of a newspaper having general circulation in the taxing unit.

The law also says that when a public notice is given it must specify the tax being proposed and the

…the date, time, and location of the meeting of the governing body of the taxing unit at which the governing body will consider adopting the proposed tax rate

Texas Budget Hearing Law

Texas law for municipal budgets can be found in the Texas Local Government Code Chapter 102: Municipal Budget.

Sec. 102.006 requires a public hearing on a proposed budget:

Sec. 102.006. PUBLIC HEARING ON PROPOSED BUDGET. (a) The governing body of a municipality shall hold a public hearing on the proposed budget. Any person may attend and may participate in the hearing.

(b) The governing body shall set the hearing for a date occurring after the 15th day after the date the proposed budget is filed with the municipal clerk but before the date the governing body makes its tax levy.

(c) The governing body shall provide for public notice of the date, time, and location of the hearing. The notice must include, in type of a size at least equal to the type used for other items in the notice, any statement required to be included in the proposed budget under Section 102.005(b).

The law also requires special notice in the newspaper and includes requirements on the size of the notice and the font size of the letters.

Sec. 102.0065 (c) Notice under this section shall be published not earlier than the 30th or later than the 10th day before the date of the hearing.

The last time the City Council reviewed the budget was September of 2014 when Clement pushed for a 38 cent retroactive property tax that would have taxed residents to a time before the incorporation of the city. The Council originally passed a 30 cent tax, but reversed the decision when they realized what they had done.

Since that September Budget Hearing, the City Council has made no effort to inform residents in the community of what future property taxes might be.

Comments are closed.